How much can i borrow mortgage on my salary

Compare Mortgage Options Calculate Payments. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow.

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Youve estimated your affordability now get pre-qualified by a lender to find out just how much you can borrow.

. How much income do I need for a 200K mortgage. Conversely if you keep your debt low you might be able to borrow as much as 6 times your salary for a mortgage. How much mortgage can I borrow with my salary.

Take Advantage And Lock In A Great Rate. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

The Best Companies All In 1 Place. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. Experts recommend that the monthly cost of the loan should not exceed 30 of the buyers income.

How much mortgage can you borrow on your salary. Compare Mortgage Options Calculate Payments. Depending on a few personal circumstances you could get a mortgage.

How much mortgage can you borrow on your salary. Your salary will have a big impact on the amount you can borrow for a mortgage. Down Payment Amount - 25000 10.

Calculate how much youd be happy. What income is required for a 200k mortgage. As part of an.

Share of Income Spent on. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Lock Your Mortgage Rate Today.

Mortgage lenders in the UK. In a practical example. For instance if your annual income is 50000 that means a lender.

Ad Compare Lowest Home Loan Lender Rates Today in 2022. Most mortgage lenders use an income multiple of 4-45 times your salary some offer a 5 times salary mortgage and a few will use 6 times salary under the right. For you this is x.

Generally lend between 3 to 45 times an individuals annual income. Under this particular formula a person that is earning. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694.

Apply Now With Quicken Loans. While you may have heard of using the 2836 rule to calculate. Ad Were Americas Largest Mortgage Lender.

Ad Were Americas Largest Mortgage Lender. Were not including additional liabilities in estimating the income. For example lets say the borrowers salary is 30k.

You can borrow up to. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Dont Wait Take Advantage of Todays Historically Low Rates While You Still Can.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Or Refinance to Take Cash Out. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

For example lets say the borrowers salary is 30k. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Browse Information at NerdWallet.

Ad You Could be Saving Hundreds by Refinancing Your Mortgage. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage. 2 x 30k salary 60000.

If your down payment is 25001 or more you can find your maximum purchase price using this formula. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice. Fill in the entry fields.

Apply Now With Quicken Loans. The first step in buying a house is determining your budget. How much can you borrow.

To be approved for a 200000 mortgage with a minimum down payment of. This would usually be based on 4-45 times your annual. It will not impact your credit score and takes less than 10 minutes.

Most lenders cap the amount you can borrow at just under five times your yearly wage. But ultimately its down to the individual lender to decide. Calculate what you can afford and more.

This mortgage calculator will show how much you can afford. Find out more about the fees you may need to pay. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. See how much you can borrow. Lender Mortgage Rates Have Been At Historic Lows.

Ad Learn More About Mortgage Preapproval. This would usually be based on 4-45 times your annual. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Lock Your Mortgage Rate Today. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

Mortgage Calculator How Much Can I Borrow Nerdwallet

Here S How Much You Can Borrow With A Personal Loan Gobankingrates

What Mortgage Can You Get On Your Salary Find Out Here

How Much Can I Borrow Depending On My Deposit Mozo

How Much Personal Loan Can I Get On My Salary Personal Loans Loan Apply For A Loan

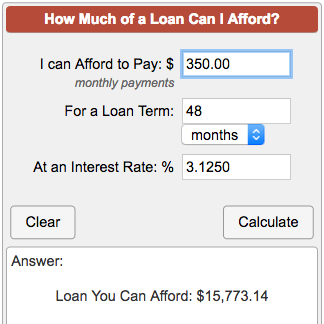

How Much Loan Can I Afford

I Make 60 000 A Year How Much House Can I Afford Bundle

How Much Can I Borrow On A Mortgage And How Much Can You Really Afford To Borrow Mortgagehq

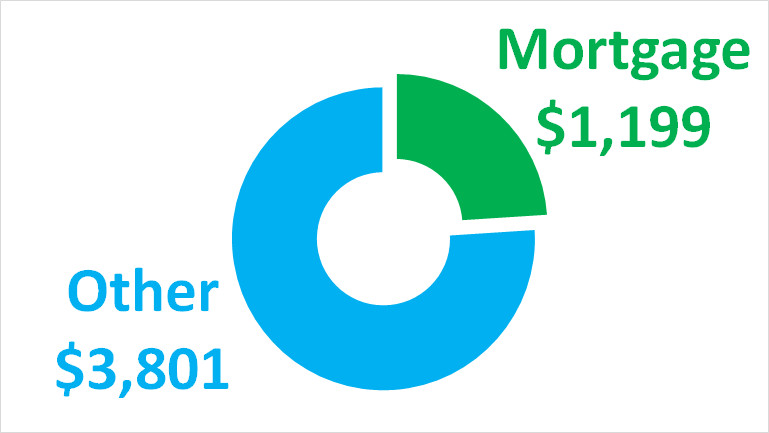

Physician Mortgage How Much Can I Afford Financial Residency

Physician Mortgage How Much Can I Afford Financial Residency

Mortgage Calculator How Much Can I Borrow Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator